Windmill Pulp: 1624, Part 4

Joffrey appears in a robe. His hair is wetted down and his skin is drooping with open pores.

Joffrey (in a relaxed and sarcastic tone): Charts, charts, charts. All it is is charts. In the tub, in the house. The course of my day could be represented on a chart. Tell me something I couldn’t have already figured out by simply looking at a chart!

Claranti (blushing): It’s Lenora. Chengdong’s men boarded their ship off the coast of Sumatra. It was an ambush. They were looking for you. They wanted to kill you.

Joffrey: Chengdong… he’s a worse pirate than he is a merchant.

Claranti: They took all the charts from her. All the pigments and scribing materials, the tools, parchments. Everything we gathered here to set up the trading factory. Even the products for the massage parlour, the opium, the rhino horns, tiger penises. It’s…

Joffrey: At the bottom of the cycle where all analysis leads to confusion and following the herd to the slaughter, the only thing a trader can rely on is his instinct.

Claranti: What!? (almost sobbing)

Joffrey: I was supposed to be on that ship. We were. Chengdong knew enough to know we should have been there, somehow our plan got out… somehow, but he didn’t know I backed out at the last minute.

Claranti: The children were hysterical, but they didn’t touch them… and they didn’t touch Lenora either, besides roughing her up a bit.

Joffrey: My children. Well they have my charts now. What more could they want, besides my head and the hand that scribes? But they’ll never get us here. And now we know their trading strategy. Oh god, what should be done? Do we really know it? What will they do with it? My charts!

Claranti: What will happen with Lenora now? Everything is ruined for her.

Joffrey: Lenora? She’ll be more than capable of getting things set up in Amsterdam. She knows lots of men there. Men who can help her, because she can help them, traders, chart scribes, merchants, company men, political men. They’re all the same. You remember our rituals? That was nothing for her, that was your thing. Back home she’s in her element. They will bleed at her feet for her and she’ll draw red lines on their charts with their blood. We need to worry about ourselves now and this Ding Donger or whatever they call him.

Claranti: The messenger boy, the one who brought the letter, he told me the Chinese merchants in Batavia were asking about our charts, they were in distress he said. This year's delivery contracts expire next month.

Joffrey: Right, Dong would be able to out-trade the Chinese merchants here with our charts. All easy markets come to an end. Once the masses catch on to the edge. We knew it would happen sooner or later. But we may just be able to get one last big pump out of it. He doesn’t have all of our charts. Only the ones Lenora needed in Amsterdam. Now we know Dong will take those trade ideas. All we have to do is front run them and they’ll inflate the prices for us. We’ll have to replenish all the supplies they stole from her. We can’t let them have that edge. Especially when we get back to Amsterdam. I know those guys are using all my charting techniques. But if we use the asian methods on top of that we’ll be unstoppable, at least until those secrets get out. You've got to talk to all the farmers, figure out what's going on with the crops and the weather. We need to know exactly what the prices are gonna be for the final harvest. And don't forget the elders and shamans. I know you’ve got some ideas going on in those realms.

Claranti (submissively): Yes.

Joffrey: Now I need to think. Goddammit I always need to think too much. Too much thinking, not enough reflecting. Screw the plan. Nothing ever works out how I think it will. I need to reflect. Action has a tendency to overstep itself and bring new problems into its existence. Action invents problems. Action is the force that creates something out of nothing. We need less things, less problems. Action should only be taken as a very last resort once the problems have gotten so massive that the natural flow could not possibly solve them. Passivity, chilling, that's the key. Only in this way will an answer naturally emerge and settle in like hot wax to the grooves of a candle holder, dripping onto the table and over its edge.

Joffrey walks back outside towards the tub.

Claranti walks slowly with her head down into her side workroom. It's dark and a thin light shines through the small window with bamboo shutters. She stands before a large dark silken fabric draped across the opposite wall. Silver and gold thread are woven into the silk composing a celestial map into the dark background. All the important galaxies and celestial bodies making up the southern sky are displayed in great detail and even the seemingly unimportant ones are included in smaller detail. Juxtaposed against the silver and gold thread is a turquoise dyed thread which traces a map of the entire east India trading region, spanning the silk background with equal breadth as the celestial map. Claranti consults a table in a book indicating various celestial positions at the current date and time. She then takes her finger and traces a line on the silk from the Taiwan straits and a tiger constellation down to Borneo where a rhino dances on its hind legs on the deck of a Chinese junk ship. She kneels down on the ground and tilts her head to the side to catch the moiré effect of the silk with her one open eye. On the ground beside her is a pile of charred bones, which, judging by the skull amongst them, are from a tiger. She takes a rib bone and rubs a line into the silk, curving and oscillating with the moiré and encircling a group of small islands. The charred bone falls out of her hand as she tips over onto her side and passes out on the floor. The mat black trace of the bone char stands out on the satin black of the silk map and has the appearance of a mad ship route through the wild seas and stars.

***

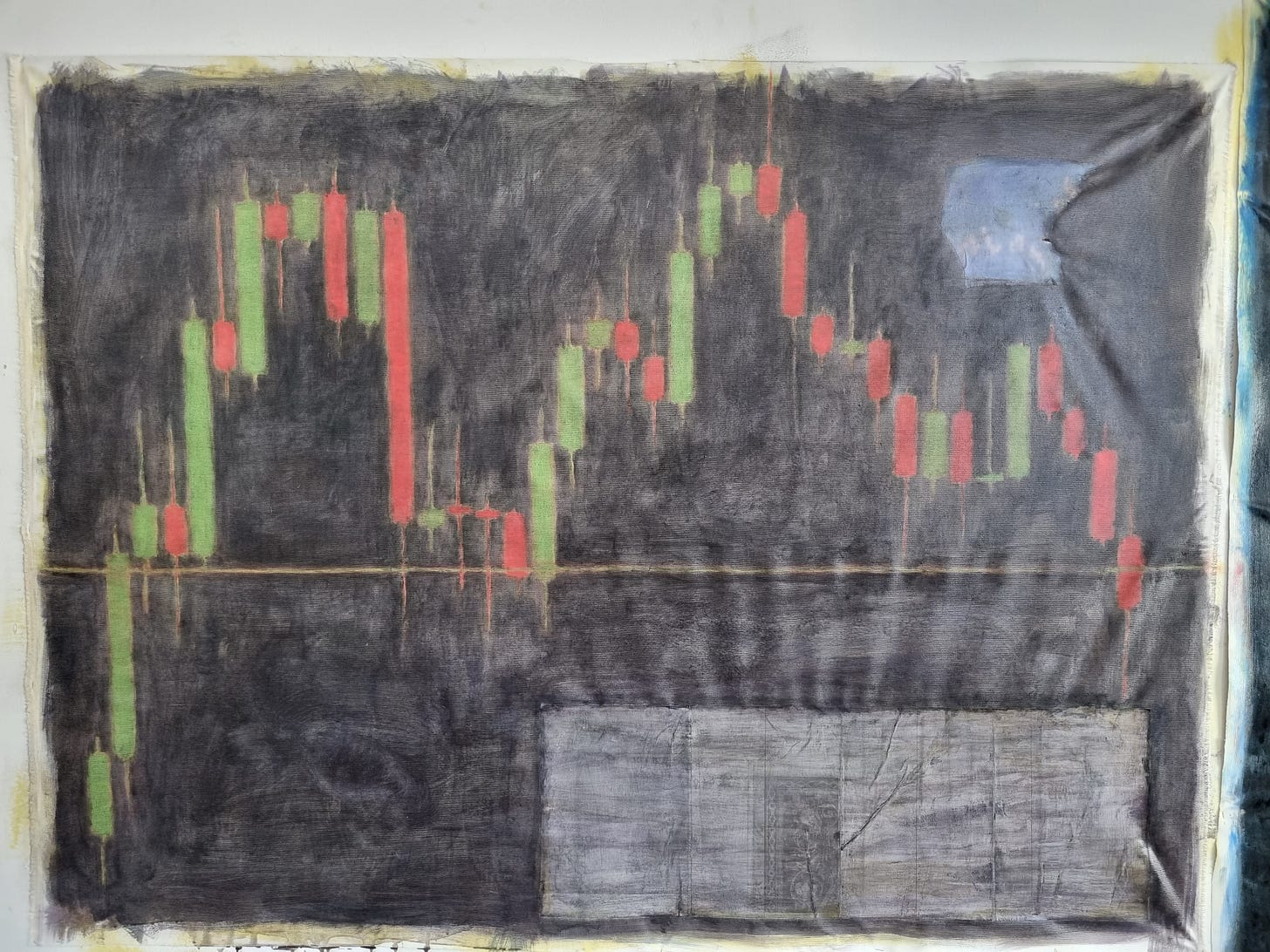

Bitcoin, loss of $32k monthly support. Oil and paper on canvas.

I don’t think I’ll go back into the tub now actually. I'm already dry and the opera of my seismic state has moved on to another scene. Some quick exercises then lie in the hammock. The key, anyways, is to preserve and naturally delineate that dreamy feeling I wake up with where there is a clarity and creativity to my thoughts. As the day goes on, it takes different approaches to follow it and reanimate it in its new forms. And for now the tub is in the past like a stage in an intense mushroom experience that seemed so important at the time but has been conquered, paving the way for newer things.

The trading stuff is really not all that complicated. It's gonna work out. Just have to wait. That's the key. Not get impatient. If I’d gotten impatient I’d’ve been killed by those pirates. The perfect trade is always the easiest one to see but at the loneliest of times. Not during exciting times. I’m still too excited. What is necessary for me is my daily reflection period, periods… reflection whenever my mental needs and the needs of the paper dictate. One, two, three… deep breaths. The push up is the perfect exercise for a chart scribe. The core strength supports the torso, sitting at the desk, and the chest muscles hold the arms, guided by the shoulders, where the triceps and forearms connect to the tendons of the wrists and fingers, working away at the paper. I am a long time sufferer of chart scribe’s wrist. Anyways, got to get on to the focusing for now. Into the hammock in the breeze under the trees.

But suddenly that feeling of optimistic lucidity has faded. The breeze has become a storm. That's how it goes when you live on an island. The weather changes and you are at its mercy. And so it goes with trading. My emotion is dictated by the price action, which can change in an instant, or slowly like the seasons. This brings in the question of time frame. Zooming in too closely on the chart, as its hypnotic power tempts you to do, can be devastating on psychological stability. Here the impact of the candles are deceptively magnified in that even a small move up or down in price, perhaps caused by a single entity making an order, can cause a massive candle to print. And this candle drags your emotion up or down with it at a scale which is relative to size and price relative to the candles preceding it. However, each candle at this small time frame, say one minute per candle, is likely to be a deviation which will be averaged out in the medium term. However harmful it is to fixate on these candles, it is somehow essential that one does so from time to time, experiencing it, learning from it. If not for the purpose of trading these time frames, at least for the purpose of knowing what is happening on a micro scale when one looks at the higher time frame candles such as four hour and up to monthly or even yearly. It is the seasonal that I concern myself with these days. The daily is the lowest I will go. The one day, three day, the weekly and the monthly are the time zones I inhabit. So much more sophisticated and befitting a man who has done his time in the trading floor trenches. When I zoom out on a chart, witnessing the rolling beauty of its curving trends like mountains on the horizon I really feel I am witnessing the slow changing of life’s journey, removed from the daily violence, dissolving into eras and periods, life chapters and spans of years, as meaningful as a historical epic where the daily brutalities all serve a higher purpose, life rolling slowly on, appreciating the darkness of winter and bright blankets of snow in the dry cloudless and brilliantly blue sky.

The burning question that bright sun asks us is of course unavoidable, even with the most optimistic demeanour, it will creep into your thoughts, how does the crash relate to this? To understand the crash, you must understand the chart. The charts are precisely not understandable. This is their entire reason for existing. They exist to shed light on the unknown objects in the darkness so that we may know there is something there we do not comprehend. And consequently we will never understand the crash. This is why it is so devastating. As with other devastations such as death of a loved on or romantic defeat, the pain is amplified and ricocheted in multiple directions multiple times because in our non understanding of the thing in question, our feeling towards it and our relation to it, we cannot grasp why it should be so painful, and reasons are invented and suppressed, and this creates more spaces for the vibration of pain to spin out of control, until it stops spinning and there is only a shell of emptiness. Here the crash has left its mark on you and the only thing to do is buy some more coins so as to further repress the fact you have no idea what has just happened.

Nevertheless, there are some things we can know about the chart. It begins with a small horizontal line, the length of a dash, provided your chart is scaled to the generally accepted size to be most readable. This is the birth of the price on the chart. As the market opens, I mean when the asset is first listed on an particular exchange, and in the most beautiful case, when the assets is listed and the formalised trading of it begins for the first time ever, as wondrous as the birth of a star, market makers, speculators, investors and liquidity providers of all kinds list their offers to buy or sell the coin in the order book. A trade has not yet taken place. These are people making offers, that is placing a bid to buy the coin at a particular price, or placing an ask as an offer to sell the coin at a particular price. The appearance of the dash marks the execution of the first trade. The first instance of someone buying into someone’s ask, or selling into someone’s bid. It is not important to understand any of these terms or how it all works. All that is important is to watch the chart, observing closely. The dash will remain a dash until a trade is executed at a different price. As a second offer is either bought up into or sold down into, the dash becomes inflated. It is now, however small, a vertical bar, or what is called a candlestick. Technically, the dash is also a candlestick, and it is entirely possible in low volume situations and on a very low timeframe such as the one second chart for a candle stick to complete as a dash. These are not textbook situations and as an observer of the chart we have a certain expectation of motion and the display of actionable information. If the vertical bar is green, the price went up. If the vertical bar is red, the price went down…

I will have to assume you know all this. As it is very boring to talk about. And if you don’t I have to suggest you pull out an active chart and have it alongside you as you read this, not just during this part, but the entire thing. And if you do understand it and follow me completely I don't have to tell you that you should have an active chart going as you read this, because I know you already do. In fact I hereby explicitly state that this is an illustrated text and the illustrations are charts, but you are charged with furnishing the chart or charts. And you shall display whichever ones are most important to you for whatever reasons and display them in whatever manner allows you to keep reading but always knowing that the charts are there and not being able to 100% ignore them. They could be somewhat dormant on your phone, on the next tab over on your browser, on a separate window behind the one you are reading but just poking out underneath the edge so that you can notice it. And in the future, as technological trends dictate, have some charts displayed in a manner that is natural to the regular consumer, nothing excessive like crazy monitors and workstations are necessary, just what is natural in your comfortable situation. And this does not just apply for illustrating this text, this is my advice for all chartists who want to properly navigate their reality. By this I mean charts should augment your inner life like furniture augments your domestic life. Inner life, yes, because charts are an art as subtle as music which can guide one through life as a soundtrack to their existence. Charts are your favourite illustrated children's book that put you to sleep and to which you will always feel a fondness. As the chart ticks away, candles pulsing at each interval, the next candle stacks above, or falls down below, a story is told through its melody, and the story is your story because you are watching the chart and the chart is impressing itself upon you. In this way the chart becomes you. There is no escaping. And the only thing to do is to let the chart be your guide. Listen to it, follow it, go where it goes, do what it tells you to do.

Red formation, sinking, then erecting up, squirting out a green wick. Wicks. Candles have wicks. It represents the portion of price action which has been negated before the candle closes. A skeleton trace of the glory or carnage that could have been. It represents irrationality, over exuberance, deviation, forced selling, forced buying. It is a graveyard for fomo. But we all fall into them. There is nothing more relieving than buying up into a wick, or selling down into one. But the reward comes from buying a down spiking red wick, and selling an up shooting green one. Not so easy, not so easy. Do not try to understand. Just follow your emotions, out think your emotions, double your emotions, avoid your emotions, get into a battle with your emotions, a friendship with your emoticons, and here you will develop intuition of what you need to do. But for now I just watch. The candle fades below its green wick, falling below its open level, the entire thing turns red, a beating heart, it falls, gives a quick stab down in the blink of an eye and shoots back up, still red, but leaving a deep wick. The candle closes. It leaves its historical record on the chart. A fairly basic candle. A nice healthy red body, with a long red tailing wick downwards and a short little nipply one on top. Really quite nice. I shall sketch this candle in my notes right now.

As for myself, as you can see, I do not necessarily need to have the charts going on around me, I’ve already got the candles burning through the circuitry of my head. But it is something I’ve had to develop as compensation to my rustic environment where no electronic charts exist and I have to draw them all by hand with expensive pigments on expensive parchment.

…Then is not the reverse true, that every time I am explicitly talking about charts and trading I am actually talking about something else, that these are metaphors for other currents running through life’s chart? Well that already answers the question, because it should be clear that trading, and the charts, as pictorial representations, as the painting is to cultural representation, is already not about itself, but is an arena for the entirety of the human, life and this world of ours, thrown into a pit to do battle with itself, and for us to observe and mock, as long as we remain diligent chartists, unlike those traders who fall in too deeply to its spell and become victim to that mockery themselves. You must constantly re-evaluate your position from different angles and through different lenses and react accordingly to make sure you are not the one in the pit being laughed at.

It is not easy. And just as in real life there are infinite ways one can become the object of mockery, shame, embarrassment. I have lived them all. Both on the charts and off. And thankfully, at some point in my career I began to keep a sort of record or trading journal of my daily struggles, to which I quote from an early entry:

“But, but, but… hyperinflation, economic crisis, delete the banks, deflationary assets…. Why, why is bitcoin dumping? Well there’s no hyperinflation yet, dweebo, the banks still exist, and an economic crisis only means more dumping… continue the dump, plenty of space for the dump to go. In the markets, space trumps time. As long as we dump low enough, down to the bottom… it can happen in a single wick, as long as it's not a glitch or a fat finger, a nice solid candle down for one day, then we can bounce right back up and keep going. The dumping doesn’t have to take place over a long period of time, slowly going down, one percent a day for years. No it doesn’t have to do that, the occupation of space only at some point however short is all that is necessary. The sad fact is though, usually the dumping does continue for years, prolonged into eternity. Every day selling, just when you think there’s no one left to sell, the selling goes on, then the people who bought the sells start to sell, weeks and years of selling, then finally on a cold day when no one's paying attention, no one except the losers selling, there’s one final wick down where the last ones to lose faith capitulate. And that’s it. The slow grind up begins. But you’ve already lost all your money buying the tops, false break-outs. The price is still so low and it's clearly gonna go up. But you have no money to buy. And you’ve been traumatised by the crashing. Even if you had money, you probably wouldn’t buy, there would be too much fear, fear that it could simply crash more for no reason. You don’t even have the nerves to steady your fingers and send the bank transfer to the trading account. You will not buy the bottom. But you are not that stupid, you will not buy the top either, but somewhere just below it. Low enough to give you a little taste of profit. Enough to keep you playing and suffering. It is not easy. It is very sad."

This represents a sentiment experienced after my first crash. Incidentally, we did get inflation this time (maybe not hyperinflation, but a good 2x inflation) and bitcoin still went down. Every crash is different. Everyone experiences every crash differently. We share many struggles with other traders amidst the crash, but we are all alone in our unique circumstances and approaches to the crash. Crashes come in waves. Crashes are dormant energy let loose like an exploding dam. Explosions are always the coolest thing. And then what? The aftermath…. Waves are complex. I do not understand them. Multiple waves can be happening at the same time, on top of each other, amongst each other, across each other, within each other, in all directions, in different substances and realities mixed together. Just look at the surface of a body of water. At a base level there is the main series of waves rolling in, the result of the natural motion within a large body of water, say in the ocean on a shoreline, they roll in, lap the shore. And then we have the waves built up by the wind, augmented by whatever the strength of the wind is. Already here the waves are far from textbook, sine waves in 3d, animated topographical ripples, colourised gif representation. They are edged, misformed, crisscrossing, irregular intervals and irregular sizes. And then, on their surface is an etching of jigsawed ripples with no mathematical coherency whatsoever and entirely unique to any other wave. And then we get waves from boats coming across all this from obtuse angles, we get infinite microwaves from infinite unknown disturbances in the stasis of the water. And then perhaps, we get those very disastrous waves of seismic origin, tidal waves, tectonic disturbances, volcanic eruptions, disastrous waves crashing through all other waves and rendering them obsolete. And there we stand on the beach. That is, in front of the trading terminal, watching the waves of market activity, confused, bored, addicted.